Optical Cable Corporation - Differentiated Cables and Infrastructure to Leverage.

Fundamentally Rugged

Originally developed for military tactical use, highly survivable tight buffered fiber optic cables were quickly adopted in industries such as oil & gas and mining, where their ruggedness and lack of sparking risk helped reduce the cost of production outages and accidents. As applications and instruments become more data intensive, fiber optics work their way closer to end users, such as in Fiber to the Antenna (FTTA) or broadcasting use cases. Compared to the underground and intrabuilding ducts fiber tended to be deployed in, these environments are usually harsher and more varied, requiring more rugged and customized solutions. Tight buffered fiber optic cables are uniquely positioned to address growing short to moderate distance applications in a convenient, cost-effective manner. With pandemic related excess inventories in the telco industry winding down and a strong demand outlook for legacy use cases, Optical Cable Corporation’s (OCC) sales of rugged tight-buffered fiber optic cables and associated equipment are likely to rebound and grow beyond historical levels in the short to mid-term.

Broad, differentiated offering of the industry’s most rugged fiber optic cables, and connectivity products to go along. Using patented designs, as well as proprietary materials and manufacturing methods, Optical Cable Corporation produces cables that have multiple times the crush resistance of those of its competitors. High customizability and kitting with OCC’s broad range of other networking products add time and labor savings, to reduced replacement and network downtime cost.

Currently depressed sales are likely to rise significantly as infrastructure and telco spending increases. Inventories built up by OCC’s customers are about to normalize, setting the business up for strong growth as purchasing patterns return to current activity levels and federal funding (IIJA, IRA) ramps up.

OCC stands to benefit from significant operating leverage as capacity utilization increases. The company’s strong asset base limits downside risk. With incremental margins in what appears to be the 40-50% range and sufficient capacity to support significant sales above its USD 70m breakeven without much investment, this USD 31m EV company could offer great optionality. OCC’s book value seems to undershoot the value of its assets, including notable real estate holdings. Factoring in net operating loss carryforwards, downside appears limited.

Optical Cable Corporation

Figure 1: Optical Cable Corporation’s headquarter in Roanoke, Virginia (Source: OCC).

Optical Cable Corporation was founded in 1983 by International Telephone and Telegraph (ITT) engineers who worked on fiber optic cable development under the inventor of fiber optics Charles Kao. During that time, ITT captured nearly all of the government-funding for the engineering, prototyping and testing of fiber optic components and systems. Key among these programs was the creation of tight-buffered, tight bound cable technology used in extremely strong, lightweight, and survivable fiber optic cables for military tactical use. As a result of these efforts, Optical Cable Corporation developed a unique cable design, using proprietary materials and manufacturing methods that to this day provides unrivalled ruggedness. OCC remains a leading manufacturer of fiber and connectivity solutions for the U.S. Military, offering the only cable qualified under the U.S. DOD Ground Tactical Fiber standard. The company has also diversified into many other industries over the past four decades, producing cables and connectivity solutions optimized for moderate-distance local area network (LAN) installations.

Broadly speaking, there are two main fiber optic cable construction types in use today, loose-tube gel-filled (LTGF) and tight-buffered (TB) cables (see Fig. 2). These two approaches differentiate themselves by how they encase and protect the relatively fragile optical fibers. Loose tube cables tend to be cheaper when fiber counts are high, and runs are long. However, due to the gel involved, splicing and termination costs of LTGF cables are higher for short to moderate length use cases, far exceeding the savings on the cable itself. Furthermore, LTGF cables are usually less rugged than tight-buffered constructions.

Figure 2: Fiber Optic Cable Construction Types (Source: Optical Cable Corporation).

Optical Cable Corporation's TB cables are helically stranded. Like rope, helically stranded subunits have a cross section offering the least surface area for the enclosed volume, and thus less contact, friction, and wear potential for a given diameter. When bent and turned the cable's elements maintain their structure, as each subunit is pulled towards the center of the cable. This means the cable's elements exert friction on each other, distributing the load put on any one of them. Another result of the helical stranding is that, in half the lay length1, the fiber is both at the “top” and “bottom” of its helix. In the case of a bent cable this means that the subunit is both on the outside and the inside of the curve, subjected to both tension and compression, which average out, leaving the fiber in an essentially neutral condition. This is important because stress can otherwise lead to fiber breakage. Repairing broken fiber costs hundreds of dollars, not accounting for the opportunity cost of the downtime created by such incidents, which tends to be much more significant2.

Helically stranded cable can also be packaged using pressure extrusion3, which is not possible for more traditional cable designs. OCC's "core locked" cable jackets use proprietary extrusion software to encase the fiber in 25% more material than traditional jackets with the same diameter. This helps keep the cable's cross-section circular, and enhances crush, impact and tear protection, thus improving durability, survivability, and reducing signal degradation.

The ruggedness of OCC's cables shows in their unique crush resistance, strong impact protection, flex resistance and high tensile strength. In fact, OCC offers cables with the highest crush resistance in the industry, far exceeding competitors' cables (see Tab. 1) at comparable cost.

Table 1: Selection of Fiber Optic Cables and Key Statistics (Source: Manufacturers’ Specification Sheets)

In fact, OCC's crush resistance exceeds industry standards by more than 10x. The company's manufacturing edge is the result of both patented designs and proprietary production methods, going all the way back to its founding. Manufacturing fiber-optic cables may seem simple, but some cabling machines can have up to 250 input variables. As part of the manufacturing process OCC's cables run through multiple machines multiple times. The thermodynamics, material science, and physics involved can create a lot of variability, which is why it takes a lot of experience and research to produce cables to the standard and quality OCC can.

Apart from fiber optic cables OCC's products include copper cabling, hybrid cabling4, fiber optic, copper, specialty and hybrid connectors, fiber optic and copper patch cords, pre-terminated fiber optic and copper cable assemblies, racks, cabinets, datacom enclosures, patch panels, face plates, multimedia boxes, fiber optic reels and other cable and connectivity management accessories. As a result of its diverse range of products, OCC is able to provide its customers with full connectivity solutions, rather than just parts of a system.

These tailored solutions can add significant value to clients. Just a few examples include the customization of jacket colors for cables and cable subunits, jacket types (e.g. low smoke zero halogen, flame-retardant, fluoropolymer, tactical polyurethane, etc.), fiber types, and protection packages (aluminum interlocking armor, fiberglass rodent protection, corrugated steel tape). Many of these customizations can help reduce overall cost to the customer, like how the addition of aluminum interlocking armor may eliminate the need for a conduit or innerduct, reducing material and labor cost. As previously mentioned, OCC also offers performance guaranteed pre-terminated cable assemblies and pre-loaded fiber optic enclosures. This "kitting" of plug and play solutions allows installation contractors to handle implementation rather than requiring the expertise of IT contractors, adding labor type cost savings to significant installation time savings.

Optical Cable Corporation groups its offerings into enterprise, i.e. small data centers, residential, campus, Passive Optical LAN (POL) installations etc., and specialty markets. Its specialty segment is again divided into the wireless carrier, and non-carrier markets, with the latter including military, industrial, mining, petrochemical, renewable energy and broadcast applications. OCC's management is hesitant to disclose details about the company's sales mix, but has shared that, excluding the wireless carrier market, specialty and enterprise markets comprise about half of OCC's sales each. The more volatile carrier market seems to account for 5 to 20% of sales, depending on the year. OCC primarily manufactures its fiber optic cables at its Roanoke, Virginia facility, its enterprise connectivity products at its Asheville, North Carolina facility, and its harsh environment and specialty connectivity products at its Dallas, Texas facility. While all facilities are ISO 9001:2015 registered, the fact that Roanoke and Dallas are also MIL-STD-790G certified speaks to the stringent quality controls OCC implements.

OCC's cables have been used to broadcast the Olympics, Formula 1, and the NFL (field deployments and sky camera system). In Industrial use cases OCC has provided solutions to wind and solar farms, water treatment plants, automotive assembly plants, steel plants, and chemical and drug facilities.

In the military, OCC's solutions are used for UAV Ground Control Systems (including Predator, Global Hawk, Grey Eagle, Shadow Raven), Air and Missile Defense (Patriot, MEADS, THAAD, ABMD, G/ATOR), Command and Control Systems (C2BMC, CAC2S), Communications Terminals and Networks (DIRECT, WIN-T, CANES), as well as other weapon and reconnaissance systems (CROWS, CCWS/TOW, PGSS). For civilian applications specific examples are harder to come by but a thorough web search will yield documents showing that OCC's products are/were used by entities of great variety including the City of Albuquerque, the FAA (e.g. Baltimore Washington International Airport), Washington State, the City of Norfolk, the Iowa and North Dakota Departments of Transportation, the U.S. Veteran Affairs' Office, the State of Michigan, and Amtrak.

For some projects OCC is the only specified manufacturer, for others OCC's products are alternatives to those of much larger companies like Corning, Belden, or CommScope. In its 10-K OCC also shares that it private labels several of its products for certain customers and other major manufacturers, including competitors. Which products and competitors is closely guarded. The importance of high-quality rugged solutions in military use cases is obvious, but these characteristics are also key in most of OCCs other markets. Skimping on quality to save a few percent on networking equipment backfires quickly if the result is a standstill in mining or transportation, the interruption of a broadcast, a breakdown of the electricity supply or the interruption of telecommunications networks.

Demand Dynamics

The more data intensive applications and instruments become, the closer fiber works its way to the end user. While copper has a proud history of stretching its capability, it is no match for fiber optics. Optical Multimode 3 (OM3) fiber, for example, has 200x the bandwidth of Cat5e copper cabling, 80x the bandwidth of Cat6, and 33x the bandwidth of Cat7. Category 5e, 6 and 7 networks are also limited to 100m runs before the signal needs to be repeated. Fiber can support gigabit bandwidth up to 1km on OM3+ multimode and up to 100 kilometers on single mode and has many other benefits including immunity to electromagnetic interference and a smaller footprint. As fiber gets closer to the end user, it is exposed to harsher and more differentiated environments and use cases, requiring more rugged customized solutions.

A classic use case of OCC's rugged fiber optic cables is the Oil & Gas (O&G) industry. Among other reasons, fiber is preferred in O&G due to its longer reach and use of light rather than electricity, which eliminates the risk of sparking in a potentially combustible environment. Currently, the U.S. extracts ca. 1,000 barrels of oil per hour for each land-based oil rig. At prevailing oil prices that is roughly USD 80,000 worth of oil. Using low grade cables means saving a few percentage points on hardware that costs a few dollars per foot, while risking downtime and forgone production. From 2010 to late 2014 OCC benefitted from the significant expansion in drilling activity in the U.S. In late 2014 a boom in well productivity led to a significant decline in U.S. oil rigs (see Fig. 3).

Figure 3: Historic U.S. Oil Field Production and Oil Rig Count (Sources: EIA, Baker Hughes).

The following drop in demand for networking equipment used by the sector was significant. While OCC does not break out its O&G revenue, management repeatedly commented on weakness in that market during this time, sharing that the increase in enterprise market sales of products launched in 2014 only partially offset O&G sales declines. OCC's competitors, including TE Connectivity, Prysmian and Belden, also spoke of weakness in the O&G sector in 2015 and 2016. In fact, TE reported Oil & Gas related revenue declines of 30% and 36% in 2015 and 2016 respectively.

5G brought with it another opportunity for OCC. With the rollout of this new technology, interest in hybrid fiber and copper cables, which are able to get both power and a lot more data to antennae, increased. According to Corning, 5G has 40x the peak data rates of 4G, 1/10th the latency and 100x the bandwidth density, measured in Tb/s per square kilometer. As the higher frequency antennae used cannot cover the same area as prior generations' the technology needs about 100x the fiber of previous generations. With the number of required antennas and nodes increasing, installation time, cost and tower loading became bigger concerns. This caused carriers to turn to hybrid fiber to the antenna (FTTA) solutions, which enable power and data delivery with a single cable. Hybrid cables typically lead to significant time savings/faster deployment, load reduction on telco towers, potential leasing savings, and other benefits. While OCC participated less in the buildout of lower data rate technologies, it has been more active in the 5G buildout.

"With respect to trends in new cell phone technology and transition from 3G to 4G, we have […] participated in selling to cell phone distribution systems. But […] I would not suggest that has any significant impact on our business on a going-forward basis." - Neil Wilkin, Optical Cable Corporation CEO (Q4 2010 Earnings Call)

"Typically, just by way of information, we do not include our FTTA product offerings on our website, since these are products that tend to be custom designed for our customers. However, we do have significant capabilities and expertise in the products used in this targeted market." - Neil Wilkin, Optical Cable Corporation CEO (Q2 2021 Earnings Call)

In 2018 OCC received significant orders for FTTA products, which helped boost group sales 37% YoY to USD 88m. Following this increase in revenue management implemented a series of initiatives meant to improve throughput and production efficiency at the company's Roanoke facility, in preparation for higher short- and long-term demand. These initiatives included the expansion, training and restructuring of OCC’s workforce. Unfortunately, problems related to scheduling changes, overtime, and manufacturing processes, resulted in unintended inefficiencies, short-term throughput constraints, and higher labor-related costs.

By early 2020 Optical Cable Corporation's management had brought these issues under control, but the company was to face further difficulties, this time caused by the CoViD-19 pandemic. That fiscal year, OCC's sales fell by 23%, in line with revenue declines experienced across the industry. In 2021 demand for networking equipment started to pick up again. Much like many other sectors, supply chain issues complicated securing the necessary raw materials and workforce to keep up with demand, while customers struggled to get their hands on product. This in turn led to double and over ordering, as “just in case”, soon to be excess, inventory built along the supply chain.

"During the third quarter, we made progress in scaling up our production team to increase our production capacity. Labor constraints have been an ongoing issue this year and we're pleased with the progress we've made on this front. We focused on getting our new production team members fully up to speed as soon as possible. And given the nature of our products, there is a learning curve as we train our new employees." - Neil Wilkin, Optical Cable Corporation CEO (Q3 2022 Earnings Call)

"Like others in our industry, some of our customers had excess inventory during the past year. The extent of any excess inventory has been different depending on the market and the individual customer. […] The wireless carrier market had some excess inventory during fiscal year 2023 and that seem to impact demand. We do believe that demand will begin to pick up again, but at this time, we cannot exactly say when and to what extent that will be the case." - Neil Wilkin, Optical Cable Corporation CEO (Q4 2023 Earnings Call)

Networking equipment sales fell sector wide as high inflation and interest rates darkened the macroeconomic outlook and customers moved from addressing inventory shortages to winding down their safety buffers. Consequently, OCC, Prysmian, CommScope, Belden, Corning and other cabling and connectivity providers saw their sales decrease significantly. In fact, in its Q4 2023 earnings presentation, Corning shared that the volume of fiber it shipped in Q4 2023 had dropped to more than 30% below its long-term trend (see Fig. 4).

Figure 4: Corning Inc. Fiber Shipments (Source: Corning Q4 2023 Earnings Presentation).

Contract installers like Mastec and Dycom, however, saw their revenue from the communications industry moderate only slightly (organic -4% and +7% vs. 2022 +22% and +21%), further substantiating the theory that overall activity held up while inventories wound down. Now, it seems like a demand recovery for network equipment and cable manufacturers has begun, with many of OCC's peers talking about an improving environment and a rebound in H2 2024.

"Orders were up 5% sequentially, with strength in Industrial Automation partially offset by typical seasonality in Enterprise Solutions. We ended the quarter with a book-to-bill of 1.03 indicating a more stable order environment for the quarter." - Jeremy Parks, CFO of Belden Inc. (Q1 2024 Earnings Call)

"In the first quarter, we saw recovery in our [Cable and Connectivity Solutions] and [Outdoor Wireless Networks] order rates as service providers have worked down inventories and demand appears to be rebounding. This is a positive sign and one that we have been waiting for." - Charles L. Treadway, CEO of CommScope Holding Co. Inc. (Q1 2024 Earnings Call)

"On a sequential basis, [Cable and Connectivity Solutions] revenue was up 20%, despite the pickup in order rates, these order rates still remain low relative to historical levels in 2021 and 2022. " - Kyle D. Lorentzen, CFO of Commscope Holding Co. Inc. (Q2 2024 Earnings Call)

"Order backlog increased 9% [sequentially]. This quarter stands out as the first time in several quarters where our backlog has shown a sequential increase. We interpret this as an encouraging indicator of normalizing ordering patterns during a build season while customers continue to work through their inventory." - Daniel R. Herzog, CFO of Clearfield Inc. (FQ2 2024 Earnings Call)

"In Optical Communications, sales were down 17% year-over-year, reflecting temporarily lower carrier demand as customers continued to draw down inventory. […] We're seeing clear signs of improving market conditions, and we think Q1 represents an inflection point. Sequentially, sales grew in both carrier and enterprise in the first quarter which is more favorable than normal seasonality, and our order rates are steadily increasing as some of our carrier customers are reaching the end of their inventory drawdowns." - Edward A. Schlesinger, CFO of Corning Inc. (Q1 2024 Earnings Call)

Going forward OCC also stands to benefit from U.S. infrastructure spending. The Build America Buy America (BABA) Act, part of the USD 1.2tn Infrastructure Investment and Jobs Act (IIJA, a.k.a. Bipartisan Infrastructure Law/BIL) passed in November 2021, established a domestic content procurement preference obligated for all Federal financial assistance infrastructure projects. This preference requires that all iron, steel, manufactured products, and construction materials used in covered infrastructure projects are produced in the United States. The White House's final guidance on BABA indicated that, to qualify as Made in America, a product must be manufactured in the U.S., with 55% of the cost of its components fabricated domestically. The White House also specified that the polymers used in fiber-optic cables, glass, including optical fiber, and fiber-optic cable are considered construction materials for BABA purposes.

Overall, the Infrastructure and Jobs Act includes USD 65bn dedicated to closing "the digital divide", of which ca. USD 4-6bn are addressable by cable and connectivity companies, according to estimates by Bloomberg and Corning. After a lengthy approval process the roll out is expected to gain momentum in 2025, with awarded funds required to be spent within 4 years. The IIJA is not the only program providing funding to network expansion. In fact, a significant amount of state and local American Rescue Plan (ARPA) funds are expected to be awarded in 2025 (see Fig. 5), and put to work in the following years.

Figure 5: Estimated Broadband Infrastructure Subsidies Based On Passed Legislation in USD m (Source: Clearfield Inc. Q1 2024 Earnings Presentation).

Furthermore, the U.S. is not the only region making significant investments in its communication networks. Canada's Universal Broadband Fund provides CAD 2.75bn to bridge the digital divide, the EU's Recovery and Resilience Facility provides EUR 10-30bn towards 5G, gigabit connectivity, and infrastructure build out, and the UK's Project Gigabit provides GBP 5bn for gigabit capable broadband in hard-to-reach communities.

OCC does sell products that are used in broadband related applications; however, the market is not one of its core targets as it tends to be more commoditized. Still, management has said that they are exploring potential opportunities in the segment. Whilst even the smallest of fractions of these government projects could make a significant difference at OCC, the company also stands to benefit from larger competitors focusing their capacity on the broadband segment, the increased adoption of fiber optics in general, and derivative opportunities originating from a more widespread fiber backbone.

The IIJA and Inflation Reduction Act (IRA) also dedicate significant amounts of funding to update, expand, and improve non-broadband infrastructure. The IIJA, for example, dedicates USD 73bn to power infrastructure and grid automation, USD 55bn to water infrastructure, USD 42bn to airport, port, and waterway infrastructure, and a further USD 116bn in public transit, passenger and freight rail, and transportation safety programs (including pipeline infrastructure and traffic control systems). On top of that the IRA adds about USD 250bn in funding for energy infrastructure, the majority of which will be administered in the form of tax credits, incentivizing private investments. The types of projects funded by these laws tend to require harsh environment cable and connectivity solutions, with many of the infrastructure end markets falling directly in OCC's wheelhouse, from transportation infrastructure (air traffic, ground, rail and public transport, pipelines, and port facilities), over critical mineral mining, to renewable and low carbon energy platforms (solar, wind, nuclear).

To provide a specific example, let us look at electrical substations, which help enable the flow of electricity from its source to the consumer by, among other things, scaling voltage up or down to ensure efficient transmission. Because of their primary function, these environments tend to have high levels of electromagnetic interference (EMI), favoring fiber over copper, since the former is not sensitive to EMI. Another factor strengthening fiber's case is that it is less likely to be hit by lighting and would not redirect a strike into machinery. Cabling at substations also tends to be exposed to extreme temperatures, dust, wind, and hail necessitating the use of rugged solutions. Being trenched or sharing a tray with heavy power cables favors crush resistant options over more standard ones. Lastly, rodents like to find warmth and shelter in substations, often gnawing at cabling. OCC can customize cable jackets by adding options such as corrugated steel tape or fiberglass yarn which help mitigate rodent damage. Similar to substations, modern water and wastewater treatment plants make use of elaborate communication and control systems requiring extensive networking equipment. In addition to dealing with the weather, vermin, and a wide range of temperatures, cables in these use cases are also exposed to a broad range of chemicals and environmental toxins, which OCC's wide range of customizable jacket types can help to mitigate.

While it is extremely difficult to quantify the impact these projects will have on OCC's revenue, it seems fair to say that the funding will provide the company with a large set of opportunities to grow its business beyond its historical size. It is worth noting that as of 2024, we are still in the early stages of IRA and IIJA implementation. Many agencies are still finalizing guidelines and application processes for various programs, some approved projects are dealing with environmental reviews and permitting, while again others are waiting for the award of competitive grants. Overall, it seems fair to say that activity will ramp up in the coming quarters and years.

"While we don't like to comment on specific markets we target for competitive reasons, but OCC is seeing additional infrastructure end market opportunities. Many of the infrastructure end markets are directly in our wheelhouse. And OCC has solutions specifically designed to benefit our customers as well as installers and end users." - Neil Wilkin, Optical Cable Corporation CEO (Q1 2023 Earnings Call)

"Overall, we expect our market opportunities to improve during fiscal year 2024 relative to the beginning of the year. We remain focused on executing our growth strategies and we stand ready to make appropriate adjustments to ensure we capture opportunities in the current market environment. That said, we have not implemented personnel reductions, like others in our industry have done. Our planned restraint in this regard is consistent with our view of expected opportunities, as well as considering the time it takes to train new personnel in certain areas of our production operations." - Neil Wilkin, Optical Cable Corporation CEO (Q1 2024 Earnings Call).

Investment Thesis, Things to Watch, and Other Considerations

Investment Thesis

In FY2023 OCC achieved revenue of USD 72m, sharing in its 10-K that it did so while running at ca. 45% capacity. If we assume that mix remains constant and utilization was consistent across the different product lines, the company has a theoretical capacity of USD 160m in sales. While this number is unlikely to be reached without additional capital expenditure, it seems reasonable to expect the company to scale to USD 100m without major difficulties. Note that, in its capacity estimate, OCC assumes 24/7 operation of its facilities, which is not unusual for the industry. In fact, based on job listings, it seems like Corning, Belden, and Prysmian are among competitors following such a production schedule, either implementing three 8-hour shifts or 12-hour 2-2-3 shifts to achieve continuous manufacturing.

As previously touched upon, demand for OCC's end products is set to pick up. The first indications of an uptick in demand were visible in the company's Q2 2024 numbers, when bookings turned positive YoY for the first time since January 2023.

"While certain of our markets continued to show signs of softness, including our enterprise and wireless carrier markets, we believe there are positive indicators in certain of our other markets. As well, we expect our net sales to begin to grow compared to the first half of fiscal year 2024." - Tracy G. Smith, Optical Cable Corporation CFO (Q2 2024 Earnings Call)

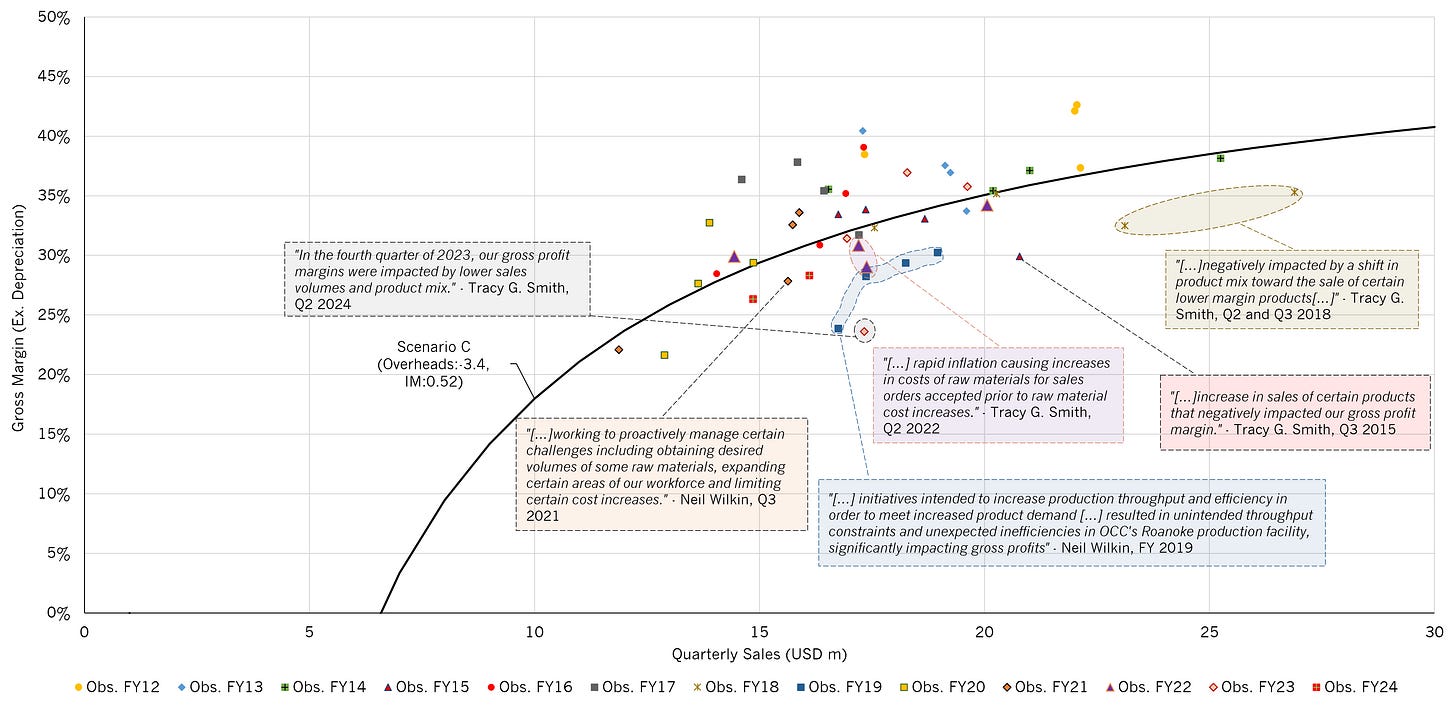

OCC's management often talks about the business’ operating leverage opportunity. For a company with a relatively stable scope and offering, evidence of this should be visible in the relationship between gross margin and revenue. Indeed, OCC seems to earn very attractive incremental margins, especially when accounting for one-off or unusual factors impacting the company's profitability (see Fig. 6).

Figure 6: Optical Cable Corporation Quarterly Sales to Gross Margin (ex. Depreciation) and Selected Comments from Management (Source: Data Provider, Quarterly Earnings Calls, Analyst Estimates)

While the company had achieved gross margins as high as 40% in the mid-2000s, the acquisitions and investments in manufacturing efficiency improvements had since created additional production overheads that the company is yet to out scale.

"We have been very focused on making improvements in efficiency and it has increased our operating leverage. We've looked at process improvements as well as how products move through the plant in order to increase that efficiency." - Neil Wilkin, Optical Cable Corporation CEO (Q2 2022 Earnings Call)

With all the distortions of the past in the rear-view mirror, management is now focused on growing sales, controlling S,G&A and reaping the benefits of the company's untapped scale. As telco inventories wind down and infrastructure demand rolls on, OCC is set to reach breakeven sales of ca. USD 70m. With incremental margins appearing to be in the 40s and the capacity to serve incremental demand well beyond current levels, the company could quickly earn income in excess of what its current EV of 31m seems to be pricing in (see Tab. 2).

Table 2: Selection of USD Statistics and 10 Year Median Multiples for OCC Peers.

Given Optical Cable Corporations size and anaemic trading volume, its stock can be subject to significant and prolonged drawdowns. To help ride out such volatility, any prospective investor should account for a sufficient margin of safety. In OCC's case the company's assets should factor into such considerations. As of end of April 2024 OCC had equity of about 22m meaning the company currently trades at a price to book of around 1x. However, there are indications that the company's accounting-based asset value is inaccurate. As of FYE October 2023 OCC carried its property, plant and equipment at a net value of ca. USD 7.1m. Gross of depreciation and amortization OCC's PP&E is about USD 39m. Of this land and land improvements, which are not depreciated, account for USD 3.1m, almost half of net PP&E. The gross value of buildings and improvements on OCC's balance sheet is 8.3m, but that number is worth further investigation.

OCC owns 23 acres of land in Roanoke County Virginia (of which 11 acres are unused), located 8 min drive from the Roanoke-Blacksburg Regional Airport, on the I-81, and near major trucking company facilities (including FedEx Freight, UPS Freight, and XPO). The company's 146,000 square foot building, built in ca. 1990, houses its corporate headquarters, administrative office, fiber optic cable manufacturing operations, and product development. According to the Roanoke County property tax register, the land and building are valued at a combined USD 8.8m an amount notably higher than OCC's total net PP&E. The county values property at 100% of fair market value using three common appraisal approaches (cost, income, sales) and allows taxed entities to contest assessments.

OCC also owns its Swannanoa North Carolina facility (a.k.a. Ashville facility) and the 13 acres of land on which it is located. The facility includes two buildings totalling ca. 64,000 square feet, housing the company's administrative offices, enterprise connectivity manufacturing, product development and warehouse operations. Like Roanoke, Buncombe County uses the sales, income, and cost approaches to appraise properties and allows taxpayers to contest the assessments. According to the Buncombe County tax registry, OCC's Ashville facility is being valued at ca. USD 2.7m (USD 1.5m for the office building and associated land5 and USD 1.2m for the manufacturing building and associated land).

The combined tax base value of OCC's Land and Buildings is thus USD 11.6m. Even if market prices were 40% below this assessment, OCC's GAAP accounting figures would assign a value of 0 USD to the machinery and equipment, furniture, fittings, and construction in progress assets it uses to generate revenue. To get a better understanding of how aggressive or conservative the tax assessment values (TAV) are we can compare TAV and market prices for similar property close to OCC's plants, combining industrial real estate listing data from LoopNet with the underlying properties' TAVs. As can be seen from Table 3, TAVs tend to undershoot asking prices significantly.

Table 3: Asking Prices, Key Statistics and Tax Assessment Values for Selected Real Estate Listings (Source: LoopNet [Accessed May 2024], County Tax Registers)

Thus, if we were to use the USD 11.6m in TAV as an estimate for the true value of OCC's properties and assigned USD 0 to the remaining assets, which seems quite conservative, they alone would increase realizable book value by USD 4.5m, taking the price to book closer to 0.8x.

Without turning this into an asset-based valuation exercise, there is at least one additional aspect that should be considered when contemplating the risk of permanent capital loss. Optical Cable Corporation has established a USD 4m valuation allowance against its net deferred tax assets associated with Federal and State net operating loss (NOL) carryforwards. The vast majority of this allowance (ca. >85%) is related to Federal NOL and does not expire, the State level allowance will not begin to expire until FY 2030. Factoring NOLs into any asset-based valuation would further expand the margin of safety, lowering price to book further towards 0.7x.

While Optical Cable Corporation is certainly not the type of blue chip, low volatility company sought out by most people nowadays, its differentiated products, attractive incremental economics, and underlying assets may pique the curiosity of the enterprising investor.

Things to Watch

Customer Inventory Drawdown: While installers, such as Dycom and Mastec, can be helpful to gauge the rate of change in the telecommunication network build out, getting a handle on inventories along the supply chain is more difficult. Sales and commentary made by OCC's competitors, whose fiscal year tends to follow the FYE Dec convention rather than OCC's FYE Oct, are more helpful. During Corning’s 2Q 2024 earnings call, held on July 30., the company stated that its carrier customers are reaching the end of their inventory drawdown, with orders starting to return to deployment levels. As established earlier, overall deployments only slowed moderately in 2023, as to the total runway in the 5G buildout, on its 2Q 2024 earnings call American Tower Corporation shared that it believes the carriers are still in their rollout rather than their densification phase, with only half of their U.S. sites hosting mid-band 5G currently and more runway internationally. Regarding non carrier customers, on its 2Q earnings call, Belden, whose sales mix is more focused on industrials and enterprise customers, shared that its orders increased almost 10% consecutively, but also highlighted that customers were still drawing down inventories.

Government Spending Rollout: The funding process for Broadband Equity Access and Deployment (BEAD), the main IIJA broadband program, requires the 56 eligible states and entities to pass several application steps (Letter of Intent, Five-Year Action Planning, Initial Proposal, Challenge Process, Final Proposal). As of Early 2024 only Louisiana had its initial proposal for BEAD funding approved, by end of July 26 potential recipients did. Within 12 months of initial proposal approval, final proposals should be accepted which unlocks the funding. Given this timeline telecommunications equipment manufacturers expect BEAD related demand to roll on in 2025 and carry through 2030. On the infrastructure side, funding for some projects has already been announced, but deployment trails the announcements to the point that relevant companies, including Nucor, Insteel Industries, Core & Main, Lindsay Corp., and Bentley Systems, expect actual bookings to ramp in late 2024 to 2025. In fact, Parsons Corp, a key infrastructure design and construction company, does not expect IIJA funding to peak until 2027.

Other Considerations

Strategic Outlook: In 2011, OCC's Board of Directors approved a Stockholder Protection Rights Agreement, also known as a poison pill, that would trigger when a person or group acquires 15% or more of OCC's outstanding common stock, making hostile takeovers untenable. The original term of the agreement was ten years, but it has since been extended for a further ten. For a strategic buyer OCC seems to be an attractive target. In 2005 management stated that the company's cost of being a public company is ca. USD 1m, a number that has likely grown since then due to regulation and inflation. Between these costs, potential savings in sales, marketing and administrative expenses, and the opportunity to sell OCC's differentiated portfolio via, what is likely to be, a much larger sales organization, an acquisition near current valuations can quickly look very attractive. OCC’s board and management own ca. 35% of the company, Ted Weschler owns ca. 10%, these stakeholders would therefore have significant influence on potential transactions.

Illiquidity: Over the last year OCC has traded in a range between ca. USD 2.26 and USD 3.82. With a market cap of USD 21.5m and an average daily volume of ca. 4,450 shares (currently ca. USD 12.2k), the company's common stock is extremely illiquid and very sensitive to market participants looking to either acquire or divest shares over short time frames. Building or selling positions in a security with such a shallow market is likely to take time and careful management of order limits. Combined with the fact that the company's poison pill effectively limits any investor's position to 1.18m shares (currently ca. 3.2m USD), the issue does not lend itself to investments by very large or liquidity sensitive investors.

If you have come this, far thank you for reading my post. If you have any questions or want to exchange thoughts on the idea, leave a comment. A like or share would be much appreciated. - Tachy

Disclaimer - This is not investment advice. Do your own due diligence. I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Tachy’s Stack is not acting as your financial advisor or in any fiduciary capacity.

The distance over which a given strand makes a full revolution around the diameter of the cable.

Studies by Gartner and the Ponemon Institute have put the average cost of downtime in the USD 5,000-10,000 per minute range.

The process of applying the molten jacket material to a cable.

Hybrid cables contain both fiber optic and copper elements. Usually the copper is used to transport electricity, while the fiber carries communications.

OCC received USD 2.2m in insurance proceeds following water damage to the office building, sustained in a December 2022 burst pipe incident. Its current state is unclear, but the conservative assumptions used throughout this thought experiment mean even a complete loss of the structure is not pivotal.

Any understanding of Ted Weschler's connection with this company or how he came to be involved in it?

With copper prices going up, could there a tailwind for fiber?