Rockwool A/S - Rock Solid Economics Obscured by Short Term Margin Pressure.

Differentiated Insulation

Seldom thought about, insulation plays a key role in the life of almost every human on Earth. From climate-controlled shelter, heat, cold, fire and corrosion protection in industrial use cases, to noise dampening the material is quasi omnipresent. Faced with rising costs for energy and the looming threat of climate change, individuals, companies, and lawmakers alike are increasingly aware of the important role insulation can play in reducing energy consumption. Stone wool products present the most sustainable option able to serve this role across a broad spectrum of use cases, as their density and structure can be modified to adapt to a variety of requirements. With energy costs making up a significant portion of the manufacturing costs of mineral wool insulation, producers like Rockwool have encountered short term headwinds, which masked the increased profitability they would have otherwise achieved at the demand levels encountered in 2021 and 2022.

Demand for Rockwool’s products is driven by secular trends with potential legislative catalysts. With insulation capable of saving more than 100x the energy used to produce it, helping retain both heat and cold, its usage will keep rising along with the increased focus on energy efficiency. Policymakers understand the potential of renovating old building stock and are working to incentivize it.

Stone wool has unique advantages over other insulation alternatives and Rockwool is leading the market. The material’s versatility allows it to cover both rigid and flexible insulation use cases, while its non-flammability, recyclability, and non-toxicity position it well to replace foam insulation in many use cases. Rockwool manufactures 4 to 5 times the amount of stone wool its second largest competitor produces.

High raw and production materials inflation has obscured unit economics over the past two years. Driven by energy cost inflation, Rockwool’s unit margins have fallen ca. 10pp in FY22. With the products value proposition inherently tied to energy costs, re-establishing unit economics would mean Rockwool trades on 7.8x normalised EBIT at cyclically depressed volumes. Based on guidance the company trades at 9x EV/ FY1 EBIT, a level rarely exhibited.

Rockwool A/S

Originally founded as a gravel mining company in 1909, Rockwool is a Danish multinational manufacturer of mineral wool products. The company started producing insulation in 1937, and in 1996 went public, 86 years after its inception. In 1981, prior to the company's IPO, members of its founding family endowed their shares to the Rockwool Foundation, which aims to bolster the social and economic sustainability of the Danish welfare state. To this day the think tank remains the company’s largest shareholder (ca. 28% of votes).

Present-day Rockwool generates revenue from the manufacture and sale of stone wool-based insulation, which accounts for ca. 75% of sales, and systems products. The latter of the two categories includes solutions for precision growing (Grodan), the automotive industry (Lapinus), acoustics dampening (Rockfon, Rockzero), cladding (Rockpanel), as well as water management and vibration dampening. Geographically speaking about 60% of the company's revenue comes from Western Europe, 20% from Eastern Europe & Russia, and 20% from the rest of the world. The company employs ca. 12,000 employees and manufactures across 51 factories in 23 countries, with offices in an additional 17.

Rockwool Group did not invent stone wool, in fact, the material is probably as old as the Earth, occurring naturally in locations such as Hawaii when molten basalt (low viscosity lava) ejected into the air stretches and cools, forming thin strands, also known as Pele’s hair. Rockwool group began producing stone wool by mimicking Pele’s hair formation, and over time the process has been much refined by modern machinery and methods, many patented, which is key to Rockwool's competitive advantage. Rockwool Group has mastered stone wool production technology, and its position as the largest producer of stone wool in the world (4-5 times larger than its closest competitor) allows it to maintain its edge through R&D investments and experience at scale.

Another advantage of Rockwool’s scale is its ability to maintain a service organisation, including personnel on the ground to help customers and installers at large sites, extensive online resources, and well staffed hotlines. This support network is valued by customers, enabling the company to charge a premium over other stone wool manufacturers’.

Stone wool's natural properties allow Rockwool to provide its solutions and insulation for residential, commercial, and industrial applications based on broadly similar manufacturing processes. The large surface area of its fibers, combined with its thermal properties, enable stone wool to reflect heat radiation very effectively. The same structures are great at holding air in place, reducing natural convection, which helps minimize heat transfer. By manipulating characteristics like the orientation of fibres and the stone content, the company can produce both flexible and rigid products (see Fig. 1), competing with paper and glass wool solutions in more residential and interior insulation use cases (lofts, partition walls, etc.) and foams like expanded polystyrene (EPS) in non-residential and building envelope applications (flat roofs, facades, foundations, etc.).

Figure 1: Rockwool's Products Cover a wide Spectrum of Insulation Applications (Source: Rockwool).

Being non-combustible is a property stone wool shares with glass wool. Expanded polystyrene, however, is a petrochemical product combustible by nature. While EPS manufacturers try to work around this issue by combining the material with chemical flame retardants, like PolyFR, the products themselves remain flammable when subjected to an ignition source for long enough. In the past some of the commonly used flame retardants have also proved to be harmful to humans. Hexabromocyclododecane (HBCD), for example, was found to be toxic, bio-persistent, and bio-accumulative and was banned worldwide in 2015. But even newer foam solutions can produce toxic byproducts. While Polyisocyanurate (PIR), for example, provides a less flammable foam alternative, just 1kg of burning PIR is sufficient to fill a 50 cubic meter room with a lethal amount of carbon monoxide and hydrogen cyanide gas (University of Central Lancashire). Fire safety characteristics are especially relevant since stone wool and foam products compete for flat-roof applications, which are increasingly paired with photovoltaic systems. Since rooftop solar panels raise a buildings' risk of fire, insurance companies have started to advise against the use of combustible insulation, including EPS specifically, which could help Rockwool gain market share in this segment.

While glass wool is non-combustible, it will melt at temperatures of around 400°C and can accelerate the spreading of fire, as some building materials, like lumber in the presence of a pilot flame, will ignite at these temperatures. Fire safety is receiving increased attention around the world, which has lead to higher demand for stone wool, which can withstand temperatures more than twice as hot, and even caused glass wool heavy weight Owens Corning1 to foray into the segment.

"[...] we've seen specifications in North America going to higher temperature ranges. So, we thought a good response to that was for us to get a little bit bigger in mineral wool. We acquired technology in order to build our facility in North America." - Michael Thaman, Owens Corning CEO (Q2 2018 Earnings Call)

In fact, its these high temperature characteristics which are key to stone wool’s ability to maintain a premium relative to other insulation materials, and are a contributing factor to it exhibiting less price volatility than alternative.

"And so […] are there competitors at lower prices? For sure. You look into Eastern Europe from suppliers on flat roof, yes, they lower prices, but there is enough market where non-combustibility and where our attributes come into play and where we can maintain the price." - Jens Birgersson, Rockwool CEO (Q2 2023 Earnings Call)

"The vast majority, for example, flat roof that we get has a fire component to it, non-combustibility component. So, it's not a direct competition. There are buildings where both can work. But the segment we play, the majority of that is with a fire component. It can vary between countries. In Netherlands, no one cares about fire properties. Germany, they do. Denmark, they do, etcetera. But just because raw material prices go down for peers doesn't mean that it'll become crazy competition everywhere because we are positioned differently. We still adhere to that, that when we have the right product and the right segment, it should have a sound profit margin." - Jens Birgersson, Rockwool CEO (Q2 2023 Earnings Call)

"The key part of this business that we really like and, historically, we've seen is while we generally see earnings movements around volumes that can move up and down. It's much less price sensitive. And that's because a lot of these products are specified. They're embedded into applications that provide unique performance characteristics in terms of thermal performance, structural performance. So that gives us the ability to price these relative to values in those price points, generally, are more sticky than we've seen historically in some of our residential applications." - Brian Chambers, Owens Corning CEO (Q1 2023 Earnings Call)

Rockwool's products are highly durable. In fact, at a recent annual shareholder meeting the keynote speaker joked that the company did not know how durable they were because the company has "only been producing them for 85 years and has not yet seen a situation where the product is no longer effective". Another attractive property of stone wool is its circularity. Old stone wool products and surplus cuts generated in the manufacturing and installation processes can be ground down and mixed in with as little as 25% of virgin input materials. During renovation projects, old insulation material is typically considered waste and usually ends up in landfills. Construction companies and installers already expect to have to pay for pick up and disposal, so undercutting waste management companies while often using the same truck that brought in the new material makes the recycling of Rockwool's products highly viable. While glass wool can sag and loose its form more easily than stone wool, the material itself is similarly durable and recyclable, foam-based materials, however, age more easily (a.o. through heat and UV exposure) and are less recyclable, which is further complicated by the presence of HBCD in the existing stock.

The location of factories also plays into competitive dynamics. By their nature most insulating materials used in construction have high volume to weight ratios, as structures that trap gasses (like air) help reduce natural convection. For low bulk density items that do not generate outsized revenue per cubic unit, shipping costs limit the economically viable delivery zone a given manufacturing plant can serve2. This usually makes it more difficult to displace an incumbent who will have strong local ties to customers and distributers and is likely to have picked their location to provide favourable access to logistics and raw materials.

Insulation Industry

The size of the global insulation market was roughly EUR 53bn in 2022, growing at a CAGR of ca. 7.8% since 2012. Data shared by Rockwool for 2022 (see Fig. 2) also indicates that mineral wool's market share in the U.S. is significantly below levels in Europe, but more importantly, that foam insulation still holds significant share across virtually all regions. As discussed previously, mineral wool products are likely to take market share from foam, as they represent a less flammable, highly durable, and more environmentally friendly alternative. Rockwool estimates that the insulation market volume for PV flat roofs will be around 30 million square meters in 2030, growing to 50 million by 2040. Depending on the geographical distribution and thus insulation requirements of that square footage, the 2030-2040 increase alone could represent an estimated 350-480k tonnes increase in potential demand for Rockwool, whose volume peak thus far was 3m tonnes in 2022.

Figure 2: Global Insulation Market by Material and Geography in 2021 (Source: Rockwool).

In addition to an expanding market share, Rockwool also stands to benefit from overall market growth. The impact of better insulation on energy savings and CO2 reduction are well documented. McKinsey, for example, ranks insulation retrofits among the highest negative abatement cost methods for tackling Greenhouse Gas (GHG) emissions (see Fig. 3), while Rockwool itself estimates the energy payback of its building insulation to exceed 100x, with industrial insulation's far higher3. Legislators and policymakers understand the energy saving benefits of improved building insulation, which is gaining increased attention as the need to tackle climate change becomes more urgent.

Figure 3: Insulation Retrofits are Some of the Highest Negative Abatement Cost Measures to Tackle GHG Emissions (Source: McKinsey).

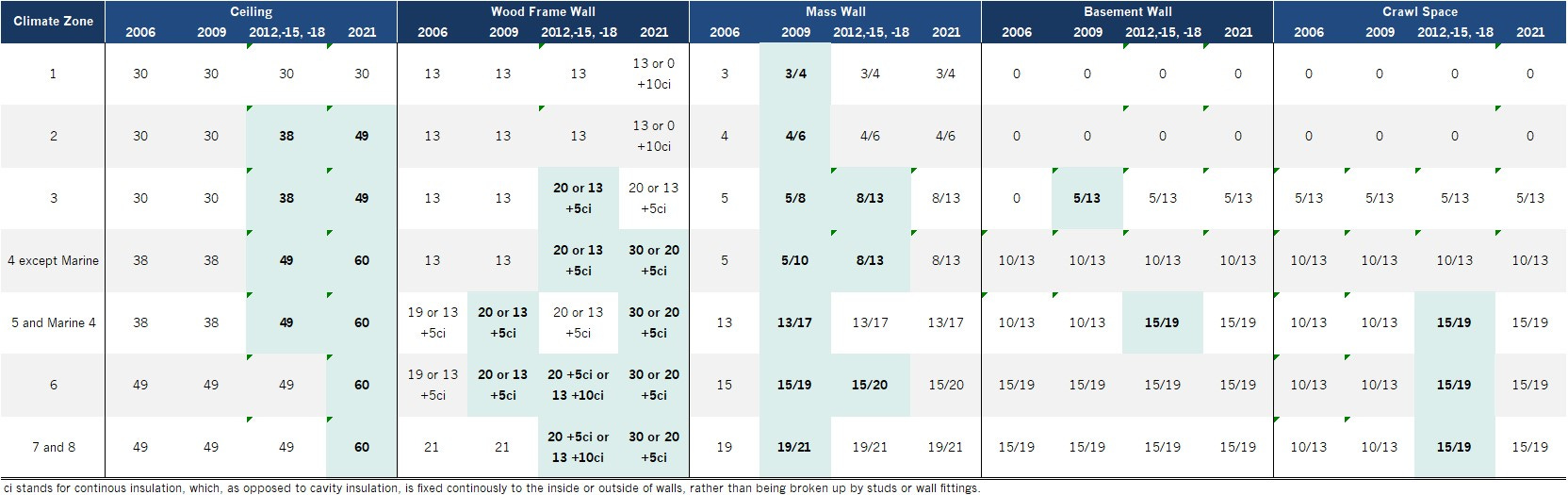

The drive to make homes more energy efficient has been reflected in stricter building standards regulations over the past decade or so. The International Energy Conservation Code (IECC), for example, is a model building code establishing minimum design and construction requirements for energy efficiency and has been adopted by all U.S. states except for Indiana and California. The code provides minimum insulation requirements for new homes, by climate zone, specified as R-values, which measure thermal resistance per unit area, or their inverse, U-factors. As you can see in Tab. 1, these requirements have clearly been trending up, which has led to increased demand for insulation material over time.

Table 1: IECC Insulation Requirements have been Rising Across Applications (Source: International Code Council).

The EU's energy standards for new buildings are some of the most stringent. However, while new buildings in Europe today incorporate on average more than 240mm of Rockwool equivalent insulation, the average European building still only possesses around 35mm. Bad insulation results in higher energy demand. Around 90% of Europe's buildings today are expected to still be in use by 2050, 75% of these were built before 1990, which is when countries started introducing stricter building codes, and 35% before 1970. The European Commission determined that about 40% of all the energy used in the EU and 36% of all energy related GHG emissions come from buildings. According to Eurostat the biggest energy use case in EU Households is space heating, accounting for 64% of energy used. Rockwool estimates that 30% of all buildings in Europe have EPCs of F or worse. To contextualize that, in France, the EU's largest Insulation market, an EPC A house uses roughly 9 times less energy than an EPC F house, in Germany its roughly 4 times as little. The European Commission believes that, in order to achieve the EU’s climate ambitions, the block must double to triple its building renovation rate, currently sitting at <1%. In fact, the EU has already mandated 3% renovation rates for all member countries' public administration buildings in its 2023 update to the Energy Efficiency Directive.

Policy makers are also working on incentivizing the transformation of private buildings with indications that the EU will target all Class F and G residential buildings to be renovated by 2033. Aside from helping to reduce CO2 emissions, renovations will decrease the EU’s energy dependency, and make fiscal sense (recall Fig. 3). According to the EU Building Stock Observatory, the Union had about 120m residential buildings in 2021. Assuming that 30% of these are EPC F or worse/need renovation, and 70% of those require insulation improvements, 25m buildings, or 3.6bn square meters of floorplan, will require insulation renovation. From Rockwool's case studies on facade renovations of large residential buildings, such as the Ken Soble Tower, Dan Court, and Artesian House, which have a lower envelope to floor space ratio than average, one can conservatively estimate that 4.5kg of Rockwool material is required for some of the least invasive renovations. So if mineral wool manages to hold its 21% market share in the EU, the 2024-2033 renovation opportunity under such regulation would amount to ca. 3.5m tonnes, or ca. 350k tons annually – 11.7% of Rockwool’s 2022 volumes and 13.8% of estimated 2023 volumes. Similar regulation has been proposed for the >5.6bn square meters of non-residential floor space in the EU.

Investment Thesis, Things to Watch, and Modelling Considerations

Investment Thesis

Over the past 10 years Rockwool grew sales from EUR 2bn in 2013 to EUR 3.9bn in 2022. This represents a 7.7% CAGR, with volumes increasing an average of 3.2% p.a. and pricing at 4.4%. In fact, over the past 30 years, the company only had 4 years of negative sales growth, as demand for its products continued to be driven by secular trends. This growth filtered through nicely, with EBIT increasing at an annual rate of 10.2%, from EUR 169m to 402m. Over the period pre-tax ROIC has averaged 14.8%, ranging from 9.9-18.2%, with management having stated that their ambition for the future is to keep pre-tax ROIC above 15% across the business cycle.

Incremental returns also seem to be attractive. In 2016 Rockwool shared that a new state of the art plant could produce 110,000 tonnes of product per year and cost about EUR 110m to build. At 2016 price, input, and transportation cost levels, as well as 70% utilisation, such a plant would have generated an EBIT of around EUR 19m.4 That EBIT margin of ca. 26%, vs. FY2019 Group peak of 13.5%, worked out to a pre-tax ROIC of about 17%.

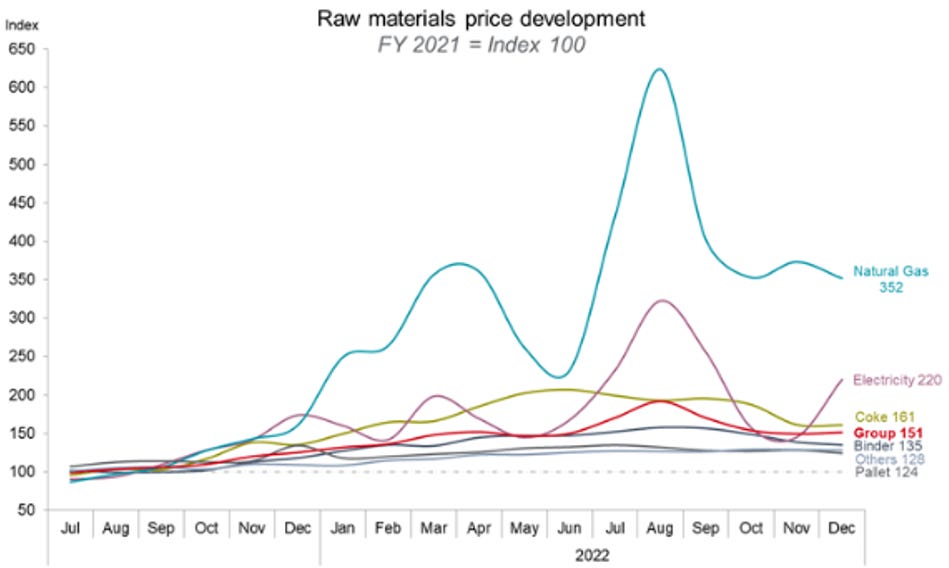

Recently, in 2021 and especially in 2022, Rockwool's real economics have been hidden by inflationary pressures. To properly understand them we need to review the company's main manufacturing process (see Fig. 4). Basalt rock, a naturally abundant material that makes up an estimated 13% of the Earth’s crust, coke, secondary fuels, and briquettes of old material are fed into a furnace where they are melted at 1,500°C. A spinning machine processes the fibres into wool, while oil and binders are added to yield a stabilised and water-repellent product. The spun material flies into a wool chamber and then a pendulum forms the wool into the defined density. On average, one cubic metre of raw material delivers roughly 100 cubic metres of stone wool. After optional facing material is added, the final hardening process involves curing the wool at 200°C. Finally, the insulation is cut and packaged for delivery. The high temperature involved in stone wool production, mean that energy related costs can significantly impact profit margins.

Figure 4: Production Process of Stone Wool (Source: Rockwool).

The abruptness and scope of production and raw material inflation over the past 2 years, depicted in Figure 5 and 6, has decreased the company’s unit profitability by approximately 10pp.

Figure 5: Rockwool Raw and Production Material Inflation (Source: Rockwool).

Figure 6: Raw and Production Material Cost per Ton and as % of Sales (Source: Company Data and Tachytelic Turtle Estimates).

This is particularly visible in how 2021 and 2022 operating margins stack up with volume produced in those years (see Fig. 75). Management is very aware of this issue and, while some of the cost increases were offset by an estimated 30% price per ton increase in 2022, they did acknowledge that there was more work to be done to re-establish unit profitability.

“We are also planning and executing on price increases so that we can get contribution margins and gross margins back to where we want them to be on a more normalized level. […] we want to get back to somewhere near that 2019 level.” - Jens Birgersson President & CEO (3Q21 Earnings)

“[On the gross margins] we also have a catch-up to do because we haven't passed on all the inflation we have seen.” - Jens Birgersson President & CEO (4Q22 Earnings)

“[Asked about the 10pp decrease in GM] We lost masses of gross margin because we couldn't react quick enough. So, our goal is to get the gross margin back and get that back what you mentioned and also improve it […].” - Jens Birgersson President & CEO (4Q22 Earnings)

Figure 7: Inflation in 2021 and 2022 Broke the Volume to Operating Margin Relationship (Source: Company Data and Tachytelic Turtle Estimates).

Re-establishing unit profitability is feasible since, as Rockwool's energy related costs rose, so did the value provided by its products and so too did the costs of its competitors. This is because the production of glass wool requires similar amounts of energy, while foam products' costs are also energy linked, specifically to petrochemicals. Since labour costs, other expenses, and many fixed costs are not going to exhibit the same level of inflation observed in raw and production materials, reestablishing unit margins should mean that overall profit margins increase beyond their historical level6.

First signs of unit economics normalisation and improved profitability are already observable in changes to the company’s guidance. At the beginning of the year management expected sales to decline 10% and EBIT margins to come in around 8-10%. In Q1 sales guidance was maintained but EBIT margin raised to around 10%, early July the company preannounced better than expected profitability for Q2, raising margin guidance further to 12%, and when reporting their Q2 numbers in late August, margin guidance was again raised to 13%. This includes EUR 27m in donations to Ukraine, adjusting for the donation Rockwool currently trades at an FY1 EV/Guided EBIT of around 9x. On an LTM basis, the company exhibited this valuation level only 1.2% of the trading days over the past 10 years, namely during early 2020 and late 2022. Again, on an LTM basis, the company's 10-year median EV/EBIT is around 17x (see Fig. 8).

Figure 8: Rockwool's Historical LTM, FY1 Guided, and FY1 Normalised EV/EBIT Multiples (Source: FactSet and Tachytelic Turtle Estimates).

Going a little beyond management expectations, knowing that revenue per ton was roughly 30% higher YoY last year (see Table 2), including some price increases in H2, can give an impression of ASP directionality.

Table 2: Rockwool Profit & Loss, and Calculated Ratios. 2017 Volumes Onwards Inferred from Company Data (Source: Rockwool and Tachytelic Turtle Estimates).

In addition, 2023 through July Producer Price Index data on mineral wool insulation in the U.S., where energy inflation was not as bad as in Europe, showed price increases exceeding 10% on average. Thus it is possible that Rockwool's ASP per ton will be up 10% YoY this year.

Assuming 10% raw and production materials cost deflation, not an unreasonable number given the significant decrease in spot prices compared to last year and the fact that this would leave unit costs 48% higher than in 2021, unit margins would be around 65%, which lines up well with their pre-pandemic average. A 6% labour cost inflation, which balances a cost/employee increase slightly below the 8.6% rise last year with some production staff cuts, does not seem unreasonable and is above where the company tracked in H1.

Integrating management's initial implicit guidance of volumes -15%, a more normalised EBIT for 2023 would be around EUR 550m. On these normalised earnings Rockwool trades at around 7.8x EV/EBIT. On an LTM basis the company has only traded at such a level for 0.4% of trading days over the last 10 years. With demand supported by secular trends and a track record of great execution, it is difficult to see how this entry point, closer to the low of a cycle than its peak, is not attractive.

Things to Watch

Russia: As of March 2022 the company operated 4 factories and employed 1,200 people in Russia, then around 10% of the company's employees. Furthermore, in Rockwool's 1Q2022 earnings call management shared that less than 10% of the company's turnover is from Russia, a number that has since probably declined as it was indicated that sales in the country fell double digits YoY in Q4, while group sales were up 13%. There are three distinct reasons Rockwool gives for not exiting Russia: avoiding intellectual property being lost, not giving regime friendly locals top notch assets below their value, and a continued ability to extract the value generated from the region, which also enabled Rockwool to make significant donations to Ukrainian causes. While the situation for western companies in Russia seems to have stabilized and Rockwool was thus far able to successfully navigate European sanctions, recently passing a Danish probe into the topic, new developments in this area should be followed closely.

EU Legislation: There are several potential regulatory tailwinds, particularly in the EU where proceeding 2022/0160, which is currently in committee, contains several amendments to existing directives that could boost demand for Rockwool's products. Specifically, this includes the European Solar Rooftops Initiative which would mandate all new buildings to be "solar ready", as well as the installation of rooftop solar energy for public and commercial buildings larger than 250m2 by 2027 and all new residential buildings by 2029. Furthermore, the proceeding would amend the EU Energy Performance of Buildings Directive, such that as of 2030 all new buildings would need to be zero emissions (public buildings by 2027), and all EPC G or worse buildings would need to be renovated to at least F by 2030, with all F or worse buildings renovated to at least E by 2033. Given that 2024 is an election year, there is much incentive for lawmakers to get the deal done before then.

Modelling Considerations

Ukraine Aid: Over the past three quarters Rockwool has donated or incurred costs related to reconstruction efforts in Ukraine amounting to EUR 40m. These included the provision of weatherized tents, portable heaters, generators, and insulation mats to the country. The related charges obscure the company's fundamentals as they are included in Rockwool's EBIT numbers. In Q2 of 2023, for example, EBIT margin came in at 14.5%, but excluding Ukraine aid they would have been closer to 16%, their highest level since 2007.

Capital Expenditures: To fuel its growth Rockwool has made significant capacity investments in the past, which make it more difficult to determine the company's underlying FCF. Luckily management has been breaking out capacity and maintenance CapEx for many years and, while EBIT/FCF conversion has averaged only 0.5x over the past decade, the ratio stands at 1.0x when adjusting for capacity investments and normalising 2021 and 2022 for the impact of extreme raw and production material inflation.

If you have come this far thank you for reading my post. There is a lot I decided not to touch on, and some corners I had to cut to keep the scope of this article “limited”, so if you have any questions or want to exchange thoughts on the idea leave a comment. A like or share would be much appreciated. - Tachy

Disclaimer - This is not investment advice. Do your own due diligence. I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Tachy’s Stack is not acting as your financial advisor or in any fiduciary capacity.

Owens Corning is the world’s largest manufacturer of fiber glass composites and is the largest player in the U.S. glass wool insulation market. It was formed in 1935 as a partnership between two major American glassworks, Corning Glass Works and Owens-Illinois. The company acquired its first “stone” wool factory in 2013.

Between 2015-2019, for example, Rockwool spent ca. EUR 330 in raw and production material per tonne of stone wool produced, while paying ca. EUR 135 in delivery and indirect costs. Senior management also disclosed that more than 90% of the raw materials used in their insulation products are sourced locally.

For reference, Vestas' V172-7,2MW Wind Turbine, introduced in April 2022, has a lifetime energy payback of ca. 34x, with solar panels closer to 20-25x.

Calculation assumes asset life of 10 years and staffing of about 150 employees, which lines up with policies, management comments, incremental and recent factory opening hires.

Note: 2021 and 2022 normalisation in Figure 7 were achieved through cost deflation to make the data points comparable to historical values, 2023 norm. also considers higher ASP.

Adjusting for donations to Ukraine EBIT margin for Q2 would have been 16%, its highest level since 2007.

You did well here!